Unitus Labs’s primary project from 2001-2010 was Microfinance Acceleration

Unitus Labs’s primary project from 2001-2010 was Microfinance Acceleration

In 2001, Unitus Labs’s founding board identified a huge opportunity to reduce poverty — to take the well-proven model of microcredit pioneered in places like Bangladesh and to introduce it in a new market-driven version to underserved markets such as India, SE Asia and Sub-Saharan Africa. To that point, it had taken 25 years for microfinance to reach maybe 20-25 million families and was reaching very few people in places like India, Philippines, Indonesia, parts of Latin/South America and most of Africa.

See Unitus Labs Alumni Microfinance Acceleration Partners

Why was a well-proven model not naturally expanding to fill the potential demand?

While in 2001 there were 1,000’s of microfinance institutions (MFIs), the vast majority of them were small, mom-and-pop type operations serving up to a few thousand clients and growing slowly. They were supported by donor funds, weren’t financially self-sustaining, charged high interest rates because they had inefficient operations and they didn’t have access to enough working capital or on-lending capital in order to increase their reach even if they had sufficient leadership and systems in place. Unlike the mobile telcom business which expanded dramatically in the 1990’s in many countries, the microfinance sector was stuck in slow growth, inefficiency and lack of capital. All this while, 100’s of millions of women waited for their first life-enhancing microloan.

Unitus Labs set ambitious, transformative goals

Unitus Labs saw the opportunity to transform the industry in order to serve many more poor women with better financial services much more quickly than the current industry trajectory. Unitus Labs established two interrelated primary goals: (1) to bring commercial funding into the worldwide microfinance marketplace, thus greatly increasing the amount of money available for microloans; and (2) help demonstrate that microfinance organizations can be scaled to serve hundreds of thousands of clients at the base of the economic pyramid.

Unitus Labs developed the Unitus Microfinance Accelerator Model

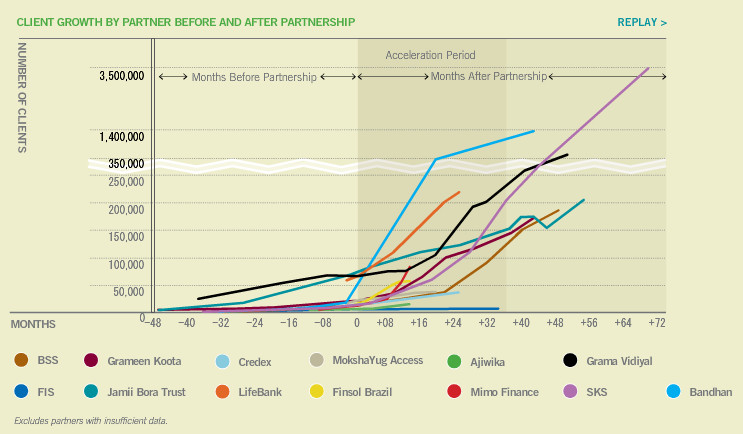

Through research and experimentation, Unitus Labs developed an approach which could help certain MFIs scale-up their client base very dramatically which we called the Unitus Microfinance Accelerator Model. Unitus Labs did extensive research to find the MFIs which we believed had potential to benefit from our program and setup multi-year, strategic partnerships with clear goals and (high) expectations. Unitus Labs provided strategic management consulting services to assist partner MFIs to adopt and integrate best practices for operations, governance, strategic planning, fundraising, structuring, hiring, training and retaining employees. Unitus also helped MFIs by providing catalytic on-lending capital (and later equity via Unitus Equity Fund) and then helped them leverage those monies to raise orders of magnitude more capital from other investors, banks and institutions.

The Unitus Effect: Dramatic client growth and more

The result is that Unitus Labs MFI partners grew in aggregate by more than 100% per year for many years — more than 8 times the industry average growth.

Additionally, Unitus Labs MFI partners set many new industry benchmarks for operational efficiency, transparency, governance, low interest rates charged, capital raised and, of course, client outreach growth.

Operational Reach: India was largest focus with targeted efforts in other regions

Unitus Labs setup a total of 22 MFI partnerships. To support our extensive India partnerships (more than half of total and, in aggregate, more than 90% of clients), Unitus Labs setup an office in Bangalore in 2005. Unitus Labs also setup MFI partnerships in SE Asia (Cambodia, Philippines and Indonesia), Latin/South America (Mexico, Argentina and Brazil) and East Africa (Kenya and Tanzania). In 2009, Unitus Labs setup an office in Nairobi and started the Africa Microfinance Growth Centre to explore the possibility of bringing our Microfinance Acceleration Model to Africa. By June 2010, Unitus Labs MFI partners were serving more than 12 million clients.

Wind down of microfinance acceleration efforts

Unitus Labs announced in July 2010 that we would be completing existing microfinance commitments but that we would not be taking on new MFI partnerships. This was a very hard decision as so much of our identity, passion and skillset had been built up around this project. The decision though was based on considerable review concluding that we were finding diminishing returns in our efforts to further accelerate MFIs. Much of this was due to the fact that the microfinance ecosystem had grown and matured dramatically in the past 10 years and most of the growth was now occurring in well-financed, professionally run for-profit microfinance ventures. In other geographies, such as East Africa, Unitus Labs concluded that there weren’t enough MFIs that were ready for our acceleration model to justify the considerable investment of donor resources.